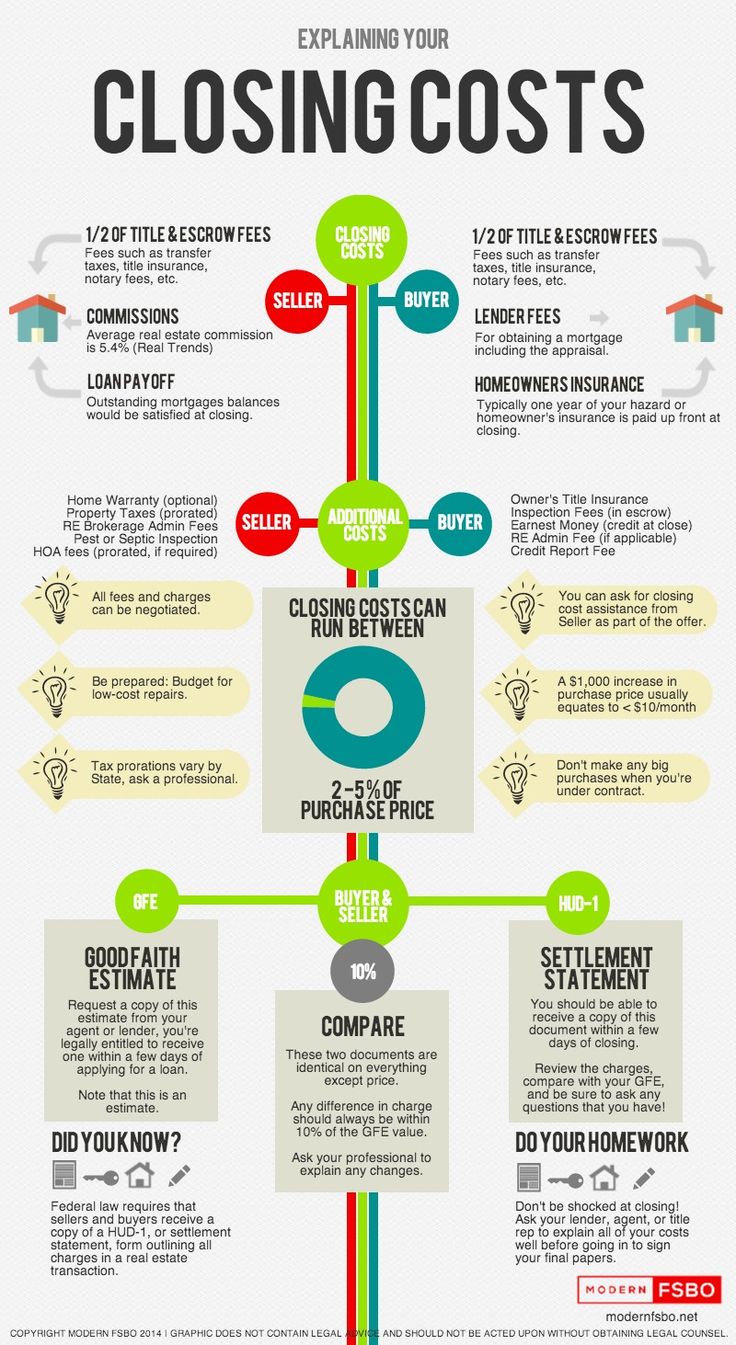

Buying a home is not something most people do very often. Which means there is a lot of uncertainty when it comes to understanding each and every fee involved. There is a lot of “behind the scenes” work involved in the purchase of a home and lots of things you may have never heard of which suddenly need to be paid. One of my buyers said, “I didn’t know how much I would be nickel and dimed.” While it can feel like your pockets are getting tugged a lot during the process, it is important to understand where that money is going and what your nickels and dimes are paying for exactly. This infographic helps break down what you can expect to pay for as a buyer and a seller at the closing table. Note it says, “Closing costs can run between 2-5% of the purchase price.” It is just as important to budget for your closing costs as it is your down payment.

Where will these fees be listed you ask? Great question! The HUD-1 Settlement Statement. This statement accounts for all the money involved in the process and is REQUIRED by federal law. There is both a buyer’s column and a seller’s column on this document which gives every detail so you can follow each penny. Since you won’t see a HUD-1 until you’re under contract, use this infographic in the meantime as guide to set expectations. As always, you should feel confident in reaching out to your Real Estate Agent with questions regarding this matter. Have a question now? Contact us here: Contact us!